- Home

- All Products

- Superyacht Deck Equipment

- Inflatable Docks

- Yacht Water Toys

- Motor Cruiser Deck Equipment

- About

- Contact

Shipping

Products supplied by Superyacht Marine Store are available for worldwide shipping via air, land or sea.

Contact us with your product requirements and shipping address for a quote today 🙂

Tax, Duties, Customs Clearance Fees:

Please note:

The Purchase Price is exclusive of any applicable value added tax, sale or import taxes or levies of a similar nature which are imposed or charged by any competent fiscal authority in respect of the Goods. The Purchaser is responsible for all and any such charges.

Tax and Duties rates vary from country to country, we strongly recommend you investigate this yourself to save any surprises !

Shipping to the EU:

As part of the United Kingdom’s exit from the European Union (aka Brexit), an agreement was reached that governs trade relations. As of January 1, 2021, the United Kingdom is no longer part of the EU single market and the EU customs union.

What you need to know

- Customs formalities, duties and taxes apply when shipping goods between EU and UK

- In order to benefit from the EU-UK Trade Agreement “zero tariff” (zero customs duties), evidence of the country of origin for goods is required and the “origin statement” must be included in the commercial invoice

Shippers

A complete and accurate customs invoice (Commercial/Proforma) will help ensuring a smooth customs clearance

If the UK shipper will act as the Importer of Record in the EU, then the shipper must clearly indicate the Importer of Record information in the commercial invoice, including:

- Business information (Name, Address, Contact Details)

- Local VAT number (of the EU destination country)

- EORI number (Economic Operators Registration and Identification)

Receivers

- Import Customs duties and taxes (or other associated customs charges) may apply

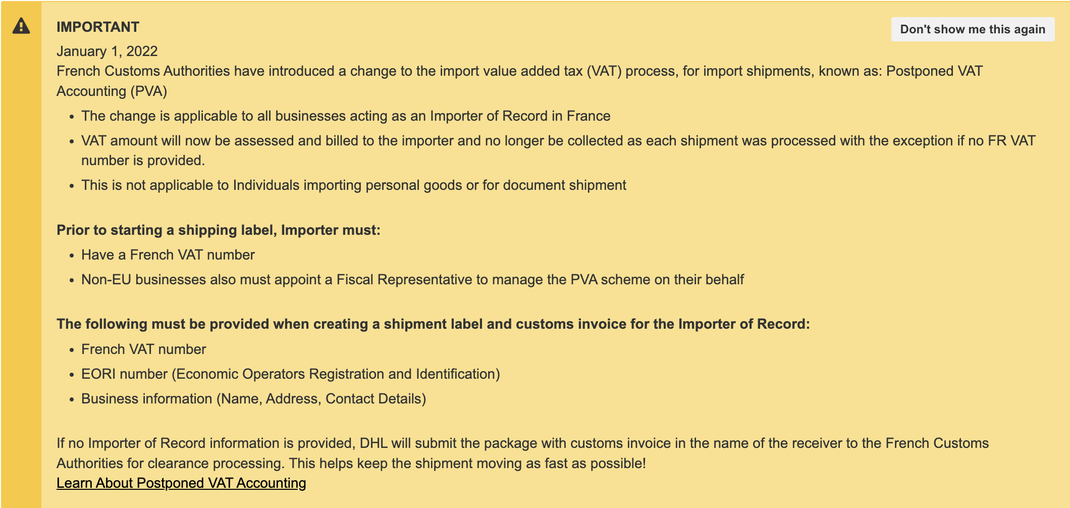

Shipping to France:

Effective: January 1, 2022 RE: VAT PAYMENT PROCESS (Imports)

What you need to know

French Customs Authorities have introduced a change to the import value added tax (VAT) collection process, known as Postponed VAT Accounting (PVA)

- The change is applicable to all businesses acting as an Importer of Record in France

- VAT amount will now be assessed and billed by the French Authorities to the Importer of Record, and no longer be collected as each import shipment is processed

- This is not applicable to Individuals importing personal goods or for document shipments

- Non-EU businesses should consult their Tax/Legal counsel to understand their obligations, including, for example, if they need to appoint a Fiscal Representative to manage the PVA process

The shipper must clearly indicate the Importer of Record information in the commercial invoice, including:

- Business information (Name, Address, Contact Details)

- French VAT number

- EU EORI number (Economic Operators Registration and Identification)

If the shipper will NOT act as the Importer of Record in France, then DHL will prepare the Customs Declaration on behalf of the consignee (receiver) as per standard import process.

Shipping to Indonesia:

Shipping to Jersey:

For: Shippers, Receivers

Shipping: Packages

Effective: July 1, 2023

Overseas online retailers are responsible for collection of Goods and Services Tax (GST) for all goods imported into Jersey.

What you need to know

Overseas online retailers must:

- Register with Jersey

- Collect GST at the point of goods purchased online by a Jersey citizen

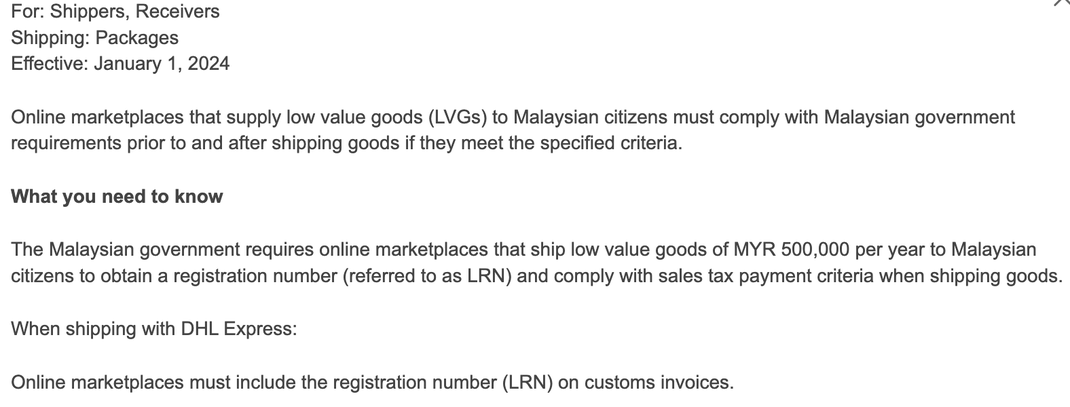

Shipping to Malaysia:

Malaysia Customs: https://www.customs.gov.my/front.html

Shipping to Norway:

https://www.skatteetaten.no/en/business-and-organisation/vat-and-duties/vat/foreign/e-commerce-voec/

Shipping to Northern Ireland:

Following the introduction of the Windsor Framework, the current waiver scheme for parcels moving from Great Britain to Northern Ireland will come to an end and new arrangements will take effect from 1st May 2025.

From this date under the terms of the Windsor Framework there will be a difference in treatment for goods going to consumers or businesses, when moved from Great Britain to Northern Ireland.

To move goods on the business-to-business trade lane that are considered ‘not at risk’ of entering the EU, either the sending or receiving business will need to be authorised under the UK Internal Market Scheme (UKIMS) and meet the criteria for moving goods under this scheme. You can now apply for authorisation under UKIMS.

Where business-to-business movements take place using UKIMS, we will act as the declarant submitting a simplified dataset referred to as the H8 dataset.

If your business-to-business goods don't qualify under UKIMS and are therefore considered ‘at risk’ of leaving Northern Ireland, a full H1 international dataset will be required for the declaration. ‘At risk’ shipments will also be charged at the applicable European Union (EU) rate of duty.

If you'll be shipping ‘red lane’ goods and will move to use a deferment account linked to your NI EORI number for Customs charges, please remember to authorise DHL to apply charges to this account. You'll need to subscribe to the CDS service via your HMRC Government Gateway account. Please check the gov.uk website for further guidance. You'll need to state your deferment account number within the shipment data.

We are unable to accept items listed as restricted and prohibited goods for Northern Ireland

.https://www.dhl.com/gb-en/ecommerce/uk/international-parcel-delivery/sending-parcels-outside-gb.html

Shipping to Portugal:

For: Shippers, Receivers (Re: Low Value Import VAT)

Shipping: Packages

Effective: March 21, 2023

Portuguese Customs Authority will apply an additional charge to shipments containing goods with a total value of 150 EUR and less.

What you need to know

- This charge is applicable to business-to-business and business-to-customer shipments

- Customs invoices should include freight charges and trade term (i.e. Incoterms®)

- The additional charge will be included in the total value added tax (VAT)

Shipping to Qatar:

For Shippers, Receivers

When shipping to Qatar ensure delivery address contains:

- Zone number

- Street number

- Building number

- Floor number

- Unit number

- City

Shipping to Singapore:

More info at: https://www.iras.gov.sg/

Shipping to South Africa:

Shipping to South Korea:

Shipping to Taiwan:

Shipping to Turkey:

Effective: May 1, 2022 - Re: VAT (Imports)

The Turkish customs authorities have changed the tax assessment threshold applied to imported goods.

What you need to know

- Business to business (B2B) imports with a value up to 22 EUR will have a flat rate value added tax (VAT) applied to shipments sent from:

- European Union countries - 18% tax

- Non-European Union countries - 30% tax

- Business to consumer (B2C) imports with a value up to 150 EUR will have a flat VAT rate of 30% tax applied to shipments.

Shipments valued more than 150 EUR require the Importer of Record to authorise DHL to:

- Clear shipments on their behalf

- Sign and return a formal confirmation via email to DHL

Shipping to Thailand

Shipping to USA

If recipient is a Business / Company:

UPDATE 21st April 2025:

The President of the United States has issued several Executive Orders (EOs) imposing additional tariffs on all countries.

Shipments over $800 (USD) now require formal entry process. These shipments are now subject to import customs duties based on the Harmonized Tariff Schedule of the United States (HTSUS), which may include: General Duty Rate, Section 301 duties, and applicable IEEPA duties.

- Ultimate consignee's Tax Identification Number (TIN) is required i.e. Social Security Number (SSN) or an Employer Identification Number (EIN), along with supporting documents as needed.

If recipient is an individual:

U.S. Customs and Border Protection require a Social Security Number (SSN) to be included in the delivery information.

IMPORTANT UPDATE 21st April 2025:

- Temporary suspension on business-to-consumer (B2C) shipments addressed to private individuals in the U.S. where the declared value exceeds $800 USD. Shipments with a declarable customs value below USD 800 are not affected by the suspension.

- Please note that business-to-business (B2B) shipments to U.S. companies with a declarable value above $800 USD are not affected by the suspension, though they may also face delays.

DHL USA CONTACT DETAILS: +1 8002255345 / +1 14806362571